Lately, the financial panorama has seen a major shift in direction of alternative investments, particularly in treasured metals like gold.

Introduction

In recent years, the financial panorama has seen a significant shift towards different investments, notably in treasured metals like gold. Traders are more and more recognizing the worth of diversifying their portfolios to mitigate dangers associated with traditional assets. One widespread methodology of investing in gold is thru a Gold Particular person Retirement Account (IRA). This case examine delves into the means of transferring an existing retirement account into a Gold IRA, highlighting the advantages, challenges, and steps involved.

Background

John Smith, a 45-12 months-old monetary analyst, had been investing in a conventional IRA for over a decade. With a rising curiosity in precious metals and a need to guard his retirement financial savings against inflation and market volatility, John decided to explore the possibility of transferring his present IRA into a Gold IRA. His objective was to diversify his retirement portfolio and safe his financial savings with tangible property.

The Gold IRA Transfer Process

Transferring an existing IRA into a Gold IRA includes several key steps:

- Analysis and Collection of a Custodian

Step one in John's journey was to analysis and choose a good custodian for his Gold IRA. Custodians are monetary institutions that handle and retailer the bodily gold on behalf of the IRA holder. John compared a number of custodians based mostly on charges, customer reviews, and providers offered. He in the end chose a custodian with a solid reputation and transparent charge structure.

- Initiating the Switch

As soon as John chosen a custodian, he contacted his traditional IRA supplier to initiate the transfer process. He accomplished the mandatory paperwork, together with a switch request form. This kind authorized the switch of funds from his traditional IRA to his new Gold IRA. It is necessary to note that this transfer was executed as a direct transfer, ensuring that John would not incur any tax penalties.

- Choosing Gold Investments

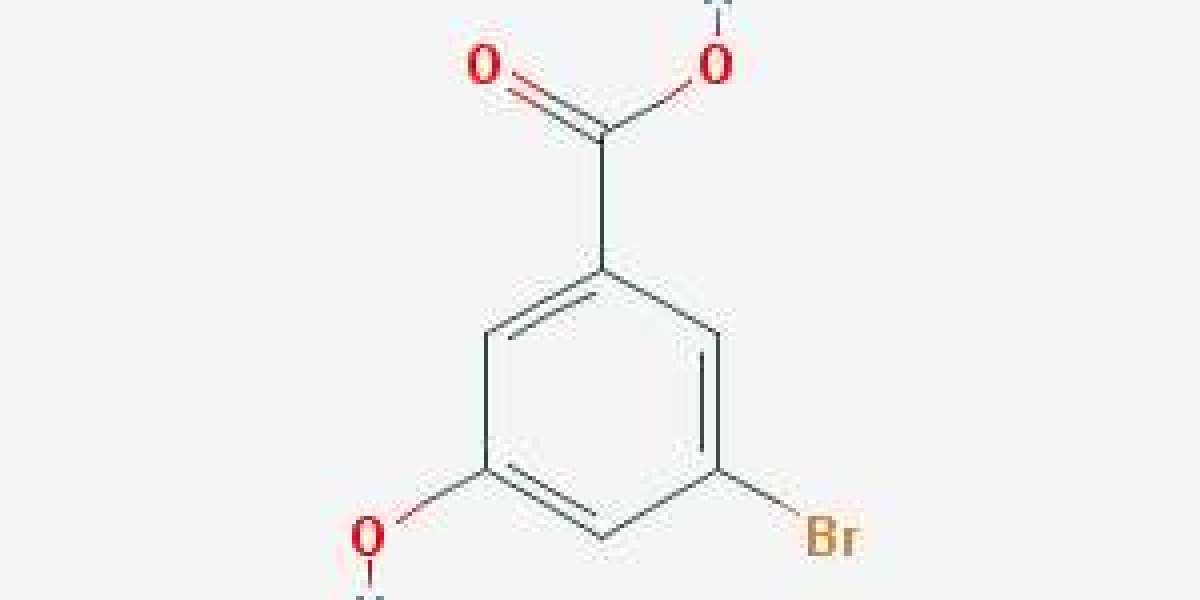

With the funds transferred, John worked carefully with his custodian to pick the specific gold products for his IRA. The IRS has strict rules relating to the varieties of gold that may be held in a Gold IRA. John opted for IRS-authorised gold bullion coins and bars, guaranteeing compliance with the regulations. His custodian provided steering on the best options out there, considering elements such as purity and market demand.

- Finalizing the purchase

After deciding on the gold merchandise, John authorized the purchase via his custodian. The custodian dealt with the transaction, purchasing the gold on John's behalf. Once the purchase was accomplished,

irasgold the gold was securely stored in an IRS-permitted depository, making certain its security and compliance with regulations.

Advantages of a Gold IRA Transfer

John's choice to switch his conventional IRA right into a Gold IRA offered several advantages:

Gold has historically been seen as a hedge against inflation. As the worth of forex decreases over time, gold tends to retain its buying energy, making it an attractive option for long-term buyers.

By including gold to his retirement portfolio, John diversified his investments, decreasing total risk. This technique is especially important in times of economic uncertainty, where traditional property may expertise volatility.

Unlike stocks or bonds, gold is a tangible asset that holds intrinsic value. This physicality supplies John with peace of thoughts, knowing that his funding is just not solely reliant on market efficiency.

Challenges Encountered

Whereas the transfer course of was largely easy for John, he faced a number of challenges:

The IRS has particular guidelines relating to Gold IRAs, together with the forms of gold that may be held and the storage necessities. John had to speculate time in understanding these rules to ensure compliance and keep away from potential penalties.

Gold prices will be risky, influenced by numerous components comparable to economic circumstances and geopolitical events. John had to stay knowledgeable about market traits to make knowledgeable selections relating to his investments.

Conclusion

John Smith's expertise with transferring his conventional IRA into a Gold IRA serves as a beneficial case examine for buyers considering related strikes. The process, while straightforward, requires careful analysis and planning. By deciding on a reputable custodian, understanding IRS regulations, and making informed investment choices, John successfully diversified his retirement portfolio and secured his financial savings with precious metals.

As more investors look for methods to guard their wealth and hedge against economic uncertainty, Gold IRAs are prone to continue gaining recognition. For these considering a transfer, it is important to approach the method with thorough research and a clear understanding of the advantages and challenges concerned. With correct planning and execution, a Gold IRA may be a strong instrument for long-term monetary safety.